When your background is in the corporate world and, in particular, in the world of start-ups, how do you harness that experience when it comes to selling a product to accountants that you know that they want, while at the same time encountering resistance from the accountants themselves? If all of that sounds a curious mix, please join me and Miranda Kendall of Spotlight Reporting on this podcast, where you'll find out the answer to this question and more. Miranda talks very passionately about why accountants do what they do and how we can harness that to enable better relationships with clients. And she's also got some really good ideas around how to effectively handle team members. I found Miranda a wonderful guest – very passionate about what she does and also very clear and concise about the importance of being present in conversations, whether it's with a client or with a team member. If you're interested in finding out more, please join us on the podcast. Scroll down this episode page for the contact information for Miranda and for the additional, downloadable resources mentioned in the podcast. |

The Solution:

I say this even to my team, don't talk about us, don't talk about this company, and that we're global, etc., you want to know about them.

The client wants to know what you're solving for them, what you're going to achieve, and what you are going to help them with.

And it doesn't matter what conversation you're having; you must make it about them. You can talk about your company and yourself at some point, because it will have to be talked about, but initially, you've got to make them feel valued and that they’re heard and you're listening.

-

SHOW NOTES

-

TRANSCRIPT

-

CHAPTER MARKERS

SHOW NOTES

Welcome to the Humanize the Numbers podcast series. Leaders, managers, and owners of ambitious accounting firms sharing insights, successes, and issues that'll challenge you and connect you and your firm to the ways and means of transforming your firm's results.

Miranda:I say this even to my team. I'm like, don't talk about us, you know, don't talk about that we're this company and we're global. You want to know about them. Like they want to know what you're solving for them. You know, what are you going to achieve? What are you going to help them with? And see 100%, it doesn't matter what conversation you're having, you have to make it about them. You can talk about your company and yourself at some point because it will have to be talked to. But initially, you've got to make them feel valued and that uh heard and you're listening.

Speaker 05:How do you make sure that you're present in every conversation you have with clients and team members? Well, in this podcast with Miranda Kendall, you'll hear her talk about how being human has affected the growth of her practice and how she continues to develop her people. Let's go to that podcast now.

Miranda:Hi, I'm Miranda. I am the director for Amiro North America at Spotlight Reporting today. I've been in software for many, many years in the tech world from corporate working at Oracle with direct industry manufacturing, so ERP solutions. And then as my career progressed, I realised I didn't want to be in the corporate world anymore. And I moved into the startup world where I first found the accounting industry. And I've been working in the accounting industry on several different software solutions for the last 15 years now, and that's been anything from working with accounting firms and then selling additional apps into their clients, which could be logistics solutions, counting solutions, to working in practice management. So people that are trying to improve efficiencies in practice management by bringing the solution to do that to free up their time, and then more recently back into advisory, where I think probably is where I get most excited about how accounting firms can actually really do more than tick task box for their clients and actually really help them be successful in their businesses. And I've done that across living in APAC, so living in Australia, working with America, and also here in Amir too. So I have a very much a global perspective on the accounting industry and the different cultures and the nuances that come with that landscape as well.

Doug:Fabulous. Welcome Miranda. Thanks so much for joining us today. Tons to dive into there already from your intro, so thanks for that. Guests we all I we always ask our podcast guests the same question at the start, Miranda. So I'm going to do no different with you. Our core purpose is to humanize the numbers, to bring a real human perspective to a numbers-dominated profession. What's your take on that? What what do you get from humanize the numbers?

Miranda:Yeah, um, for me, and and it comes from working with an accountant myself for for me, is I don't I don't I think it's getting from behind your emails off the you know, the phones are good, but really being present and in front and understanding the person that you're speaking with, and I don't think that's just in accounting, that comes even with you know, even within my role, you know, and looking at my team is how do I understand those individual people on a personal level? You shouldn't, if you can understand someone on a personal level, I think it gives you that better understanding though, and understand them on a business level as well. And you've got to be talking to people, you can't not interact and have a conversation, you're just not going to be successful in whatever you do, and you can bring that into any any industry, not just accounting. But I know we're talking about accounting today, so it is fab. I think it's very personal.

Doug:Yeah, it's a nice phrase being present, isn't it? Um just confers that you know you're my top priority right now. Let's let's talk it through. Yeah, fab. You you mentioned in your intro about sorry, carry on, Miranda.

Miranda:No, I was gonna say with that and the present is is all that also about being authentic and bringing authenticity to to that moment because again, you know, a lot of the time we get lost in you know going through the process, and then you know, you're trying to act and be something that actually isn't genuine and isn't delivered in the same way. So being authentic plays a key part in being humanizing.

Doug:Yeah, absolutely. Yeah, thanks. Um, you mentioned about in your intro about in the corporate world, I was 22 years in RBS as well, so I have a fair bit of experience of that too. What what specifically was it about the corporate world that you didn't like that eventually tore you away from it?

Miranda:Yeah, you know, um it's a very cold world, and it used to be um one, very maloriented back in the day when I was there, but two, again, you you you couldn't uh you if you had an idea, you you really couldn't share an idea, you know. This is what we do, and this is how we do it. It's all policy-driven, red tape, and they're a business, they're all about their number, and they aren't about don't quote me on this oracle, but they're not about the customer, like there's that level of that's missing again. That being human, you know, and going that extra dirt, you know, extra step to make um that customer happy and being able to do something like different to get a better outcome with them. Your hands are very tired, you know, it's a very much yes-no, you know, in in the startup world, in the app world that we're in now, you know, people do still say please and thank you, or they'll be accountable and they'll apologise in a corporate world. You just don't get that, it's very cold and direct. Um, and I had some managers and I knew what kind of person that I wanted to eventually aspire to, and who I didn't want to aspire to from some experiences, so it was a great ground for me to starting. Amazing training. I think the training that comes with corporate world that you receive is you know second to none. But I I felt that I couldn't be who I wanted to be. I had to be in a particular mould. I if I'm really honest, and I wanted to be able to just be myself.

Doug:Yeah, yeah, I can very much relate to a lot of that as well. I I was the same I I had latterly I found a job that I loved and I was good at. Um but of course, being a large corporate, the the promotion that inevitably followed was all about taking me somewhere that I couldn't be my authentic self and and wouldn't enjoy it as much. And I I remember talking about it with them and they just couldn't compute that at all. But we'll give you more money, and yeah, but I'll not be happy, but but you will because you'll be paying you more. No, but I won't be doing a job that I'll be happy doing, so yeah. I just left in the end, you know, I just got fed up, so um yeah, I can relate to that a lot. It was interesting about what you said about training too. I experienced exactly the same that the training it felt like we were trained to within an inch of our lives. The there was so much good training going on, and yet when I came to accountancy, I saw the complete opposite, especially in the the so-called softer skills, um, which aren't softer by the way, I think they're really hard skills, but the people management, uh you know, the people management side there seemed to be and still seems to be very little focus there at all. Uh any observation on that at all?

Miranda:Yeah, no, I I would agree with you, and it's hard, isn't it? Because you're right, we are were trained in the you know, to stand up and now to present and it had to be pretty pristine, and you know, you were called out for this and called out for that, but they don't teach you the soft skills, they don't teach you uh how to have empathy, you know, those type of understandings when you're in a business conversation with someone, you know, that are stuff that you have to learn on your own. Whereas moving into a small startup environment where you know there is no one else to back you up, there's not a team of 15 people supporting in you, you quickly go, Oh my gosh, you know, I need to understand this in the business, I need to be able to make this decision because there's not someone I need to run to, or you know, um, if you're working with a client and you know they are struggling, the ability to be able to support them and say, Okay, look, we understand we can help you. You know, I don't know, let's discount um to help you with the the fundings while you get sorted, you know, just gives you that much more flexibility to learn them soft skills and being, I think, in a much rewarding and challenging environment when you're up against that with a customer. Um, I think that that would be my my take on it.

Doug:Yeah, absolutely. Before we dive into more of the corporate stuff and and the background and whatnot, Miranda, tell us a little bit about yourself. Um, this is the humanize the numbers podcast, so we better be a little bit human, uh, your interest and where you grew up and whatnot.

Miranda:Yeah, uh actually I I was born and uh in East London originally, and then I actually emigrated to Australia in 1996, and I spent 30 years there. I then I did a few years and lived in Singapore as well, all in the corporate environment, and then when I came back to Australia, that was my step up into moving into start-up. I've got a beautiful daughter named Takara, and we're very much into our horses, she likes to ride in, so we've got a few horses that takes up a lot of our time, and then I you know very much a lot of time, um, not a cheap sport either for anyone out there, but I think very hard if you want to step into that arena, and um and then I love keeping fit, I do lots of running, yoga, and then my other thing when I do get time, which is not always that often, but I love to upcycle um strip furniture and upcycle furniture and paint it and do that kind of stuff. That's probably my um my release of something completely different to being in sales or customer success.

Doug:Yeah, very creative as well. Yeah.

Miranda:I don't know if I'm very good at it, but I definitely enjoy it.

Doug:Yeah, I like to have Sister-in-law's recently got into that, and and some of the things that she does is just amazing. It requires an imagination that I don't think I've quite got, but um, but yeah, I admire those who can do it. Yeah, Fab, thank you. Yeah, um so uh in terms of um the startup world that you talked about earlier, tell me how that um worked for you. How did it differ from corporate and I you know I I know it will differ dramatically, but just in what ways did it really um set you free in some senses, or in other ways restrict you or hold you back if that happened? You know, how did it differ?

Miranda:Yeah, I I it certainly didn't hold me back. I've um it was a huge learning curve because all of a sudden I was, you know, I I I I got made a a sales director. Um I had a um a team, wasn't a big team to start with, but I had a team, and all of a sudden I've gone from very much focusing on you've got a team, it's the number, this is what you need to do. Um, you know, these are the accounts, you know, big corporate accounts we're working on, to all of a sudden looking at PL, you know, understanding how I like to do my own forecasting, sitting in a boardroom about what I see as changes that we need to try and reflect to, you know, to grow the business. I sort of went from sitting in a very comfortable armchair to I was just chucked in the D10 and like my gosh, my step of growth just had to happen overnight. And there was times when I was I honestly I'm thinking, oh my god, I don't know if I can actually do this, like I just don't really have the experience. But I absolutely loved it, and I I got to touch every part of a business, and so my knowledge and understanding of how to run a business just totally changed overnight. It just gave me such a different perspective, and it was you know, I was it was like running your own little business, you know. This was mine, like I you know, I was customer success, I was sales, you know, I was allowed to put together ideas and present them and give input, and because I initially that startup world was back into supply chains, and my I came with a huge amount of knowledge of understanding ERP systems, and you know, there's these people that were listening to me and you know taking it on board, and we made changes to the roadmap, and yeah, I loved it, absolutely challenging. Um, threw everything into it, worked stupid, stupid hours. That is, you know, we work long hours in corporate, but it this did take my life over, but I loved it because I'm I you know I was so excited to get up every day, it was just awesome, and um yeah, I'm YouTube so much, and we grew the team. I went from um having people only over in New Zealand to then opening the office in Australia, the first one, even got the opportunity to come to the UK to see how we was gonna spearhead it here and open the office over in the UK. So, yeah, I just I was absolutely living the dream. Fantastic, really enjoyed it, but very challenging. There was times where I was like, I don't know how to tackle this one, so I had to find some mentors that I could bounce um things off of and uh you know get some advice because it was new new stomping ground for me.

Doug:So so what did you learn about yourself in that phase of your career?

Miranda:That I uh that I'm a very much a control freak more than I realised, good and bad. Um I was very much a control freak. I loved being at the forefront and being and leading and growing people and developing people. Like I think if someone says to me, What's your biggest reward out of everybody that's ever been in my teams? It's seeing them grow, pushing them out of their comfort zones, seeing them grow, and then you know, not always staying with the business that I'm they've been in with me, but moving on and moving up their own career paths. That for me is probably the biggest reward that I get from my job that I do.

Doug:Yeah, yeah. It's interesting, isn't it? How many leaders seem to be threatened by someone who's better than them at certain things? Not missing the you know, the whole point of the role is to do exactly that, to get people who are better than them. It's yeah, exactly. Any thoughts on that at all?

Miranda:Yeah, no, and they're they are they are out there. I mean, I've worked for some of them where you know you can feel they're they're almost trying to keep you back in the corner, and I and I'm the complete opposite. If I can, you know, I can't sometimes I don't delegate when I should, but there are times where I go, do you know what? I know I know who I'm gonna pick for this, it's gonna push them out of their comfort zone, but they need to do it. And at the time they probably dislike me and they're like, What are you doing? But they they're a way to come back and go, Oh my god, you know, thank you for making me do that, you know. I would feel like I learned a bit more about myself, and then they find out is it's something they do or don't actually want to do. So I think that is as important in pushing people to try something new in their roles, and it keeps you excited because we all have a day-to-day job we have to come in and do, but we also need those little extra projects or something different to keep it fresh and exciting, and by allowing people to do that again, it is helping them grow and help them navigate which direction they might potentially want to go in in their own careers.

Speaker 05:Please forgive this brief interruption. You just heard Miranda Kendall talking about how she grows and develops her people. In the show notes, you'll find a link to a business breakthrough on this same subject. Back to the podcast.

Doug:Yeah, absolutely. Um I mean, I alluded to it earlier at RBS. I eventually found a job that I genuinely loved doing and was good at. Um but it taught me a real life lesson to you know to not put up with or not chase the wrong things. Um, in the pursuit of this corporate dream for me, it was all about status and the money and whatnot. And then eventually I had a word with myself and said, you know, just do stuff that you love. And it just felt like a whole pressure away from me. And and I find that challenging, and I'm interested in your views on this, Miranda. When I'm talking with accounting firms now, and especially their younger team members, very often they don't know what they love doing yet, and it's just a case of trying different seats. You any perspective on that at all?

Miranda:Yeah, I do. I I I actually find with the accounting firms that we talk to, and I think this is a shift that needs to happen, because one of the challenges I see in the role that we play at the moment is that accountants or counting firms, those that are client-facing or should be, actually really struggle still with talking to those clients and you know, moving away from compliance to advisory. And what we tend to do is when we do bring some new people on board, we put them in the room at the back because they've got to earn their stripes. I think that shift's got to change. It's like, well, yes, but take them out on them visits you again, get them exposed to this. Is this this is the role, you know, to be in front of your customer and having a conversation with them, you know, understanding what success means to them, and you know, what is it an exit path they're looking to do? Are they looking to expand? If you can't understand your client's milestones or strategy, you know, of what they want to do, how can you shift from being in the compliance role to advising them, becoming their business coach if you don't know what it is they actually are trying to achieve? And I think I see that more and more is a huge gap that we have. You can give someone all the tools in the world, but you can create a report, but if you can't talk to it and work with your customer and be present, um you're just not gonna ever get see a result from that, and they're not gonna see the value from you. I mean, you know, yeah, improving the value is is the key piece here, isn't it? And you can only do that with knowledge, so yeah, I think that the new younger generation need to get a flavour of that very, very early on to not have the fear that a lot of countents have today to go and talk and position themselves as not just someone that does the tick boxing in the box for you know your compliance work. Actually, someone I was we did an event actually a few weeks ago, and someone in their presentation had turned around and said, um, act like a robot, be replaced by a robot. And I thought, oh my god, I love that saying because that's so true now, isn't it? So I've used it a couple of times. Yes, I probably should name who said it, but um, yeah, and I it's it's true because of AI coming on now, it's not gonna replace us as humans. I don't agree with that, but it certainly is for things like the compliance work and other stuff that can just be run by AI, but you should be taking that as an advantage to go and spend time with your customers, go and hear them, listen to them, you know. Yeah, I think also understanding do you want to actually move into that space, or are you very comfortable being in the you know, high volume, you know, lots of customers doing compliance versus being niche and looking at what your service matrix is that you want to offer, which would allow you to move more into that value if you had a pyramid um level, and that means spending time with customers and the right customers that wish to engage your services to do that. That's been a bit okay then, didn't it, from what you're written last year?

Doug:No, no, no, it's all really relevant, um, yeah, and you've made me think a lot of things, Miranda. Uh first of all, I think the you know, my take on it is that the in terms of why accountants don't do more, is simply because the model encourages it, they're paid for compliance. And you know, when they get out of bed on the first of January, um they know that their income is guaranteed pretty much a hundred percent. Okay, they'll lose one or two clients, but they'll gain one or two, so there there's no pain or stimulus for them to change, and because they're paid for compliance, well, why would they bother striving for an additional ten-twenty percent on top? Now, as you rightly say though, AI is going to bite into that compliance significantly over the next few years, um, if it's not already. So there is going to become a pain and a compulsion to change. Um and I often get there, I don't know if you've you've probably heard all the the same arguments against it as I have, but often accountants will say, My clients don't want that sort of thing.

Miranda:Yes.

Doug:And I'll often challenge back by saying, Well, how many times have you asked them?

Miranda:Yes, that's exactly what we do. Like, have you gone and asked them? And and again, it comes back, you know, that shift of stop selling time but build value. And I I think there needs to be a mind shift, and not everybody's going to do it, and then they're not, they don't, it's not what they want to do, but there definitely has to be a shift in mindset from selling time to selling and or to building value, and if they go in with that mindset to talk to their customers, then they don't they're not selling, they are gonna be able to position themselves that they can build value for that customer.

Doug:Yeah, yeah. So when you're talking about um advisor, what what what other objections do you get from accountants about why they don't do more of that?

Miranda:So one of them is it needs senior people to be able to be knowledgeable, so the younger gener younger people don't have any of the you know the tips in their armour, they haven't spoken to enough customers to get another understanding, especially with if it's you know in a particular um industry, you know, if it's hospitality or you know, construction, they don't have the youth under the belt to be able to come across as knowledgeable, which is why I say bring them in early so they can start getting exposed. So senior people, the CAT 22, they want to do advisory, they've put you know, they don't often have plans. I am I should say I'm not surprised anymore, but I do get surprised with I talk to accountants, and and and I'm not talking like a small accountant or mid-market, even the big firms do not have a strategy in place, they have not set out a clear timeline of how they're going to achieve doing that shift to I don't know, 60 or 40, 40 compliance, 60 advisory. Again, it's a reactive, not a proactive, and then the the smaller firms are we want to do it, but we need to hire more senior people, but we're not ready to do that, or we don't have the right client base, so they want to find the right clients first, and then if they so they try and try and scowl before they're actually growing, but it's difficult because you know they want to bring senior people in to help to be able to deliver the value add piece of the advisory of taking them numbers and what does this really mean? What do you need to focus on to achieve the outcome that you're looking to do for your particular business? So it can be a bit of a catch-22, and that's why I see that. Um, time, oh just don't have time, like you know, don't have time. Um two, oh customers just see us as the numbers people, you know, they they don't want to talk to us, right? And as you said, you you throw it back to them, and like we'll have you try to have a discussion, um and you know, we give advice, we do have a platform, but we have um an academy piece to us called Transform in Action, which is where we try and help the firm to start being out of position and talk to their um customer, and it might be okay. Well, initially build a report, maybe share it, see if it actually attracts some you know interest, you know, slip it into the next one. It might be a one-pager, bring it up, it opens up a discussion and see if they want more, or you know, do a Loom video to your report, share your own knowledge, you know, and send it that way rather than just emailing it to them and hope they open it up and read it. So there's like I think different ways that you can start approaching it to start getting some uptake and input from your clients. But the first step is you need to really look at your service matrix and who your clients are, and do you actually have the right clients to start with that will want to work with you in advisory? Because not all clients do, you're still going to get some that would say no, and then yeah, they'll say clients can't afford it, they don't want to pay for it. And then so they don't and then they say they say they do some advisory, but really all they do is give them a reporting, and then they don't charge you know their their right um value from that, they don't monetize it properly for them. So again, they can't start growing because they're not actually charging what they're worth.

Doug:Yeah, yeah, absolutely. Um, yeah, there's a lot in there, um Miranda, and we see exactly the same things. Um given the the the shift towards AI and the effect it's going to have on the compliance side, though, I I I'm with you that I think um there is now becoming a compulsion to change. Um how do you counter you know the the age thing that you mentioned, for example? What's your what's your view on that? Because you know, I think back to when I was in business development at RBS, I just used to ask questions. I always used to insist on going to the client's premises first, and then always insisted on being shown around before we sat down to talk about whatever it was they they needed. And inadvertently the client would tell me loads of things. You know, we're I ideally we'd expand that. We're a bit cramped here, but I don't really have the you know the money to s uh to do that sort of thing. Or I'm thinking of taking on one or two new employees, and all the time I'm thinking, oh right, okay, you could help with that, could help with that, could help. So I had a shopping list of about a dozen things before we formally sat down, just by listening. So I find it challenging that accountants seem to have a slightly different perspective in the main, not not not everyone, um, but in the main where it's their agenda about their numbers as opposed to the client's agenda and what's important to them.

Miranda:Yes, yes, absolutely. And again, in the and I think you can apply this to anyone that is trying to sell their time or even a solution that's gonna help their customer. Yeah, you know, I say this to even to my team. I'm like, don't talk about us, you know, don't talk about that we're this company and we're global. You want to know about them, like they want to know what you're solving for them, you know. What are you gonna achieve? What are you gonna help them with? And see I have 100%, doesn't matter what conversation you're having, you have to make it about them. You can talk about your company and yourself at some point because it will have to be talked to, but initially you've got to make them feel valued and that uh heard and you're listening. Um doesn't matter how who which environment you're working in, you've got to make about the person that's agreed to meet with you and chat with you, and don't do it in an office, I do it over a cup of coffee. Right when people are fine, go and cup of coffee, they're relaxed. Um, you know, it's it's still a business meeting, but people just it'll make it flow and have a you know, like you say, you know, talk to you about all sores, um and you come away with like this idea, that idea, and how can I then position that? And I think that that's probably one of the easiest and most comfortable environments to be in is to just take them out of the office.

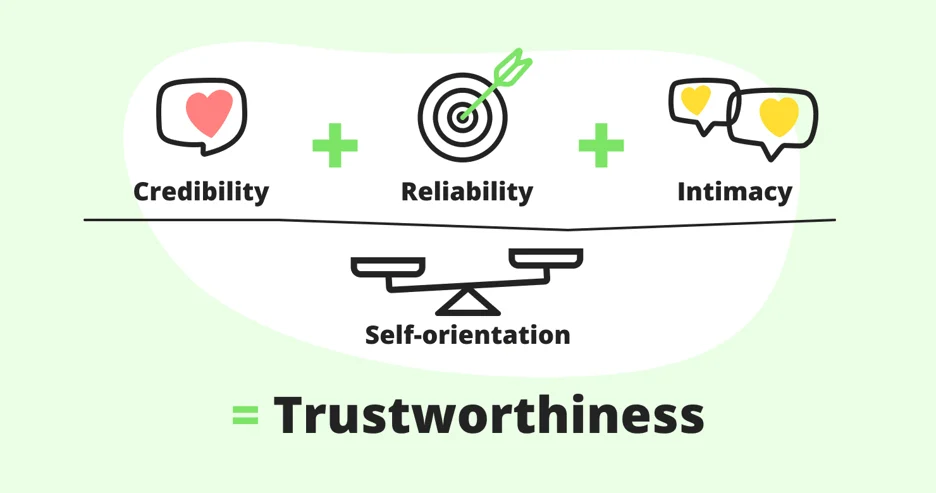

Doug:Yeah, you've made me think of um a little bit of IP that we use, it's the trust equation by a guy called Charles Green. I don't know if you've heard of it.

Miranda:Yeah, I I haven't.

Doug:Credibility plus reliability plus intimacy divided by Self-orientation. And of course, because most people go into a conversation or a meeting with their agenda, I've got to get through this, I've got to talk about the figures, I've got to ask about that, I've got to get this signed, and blah blah blah. So their self-orientation is really high, which ironically makes them less trustworthy.

Miranda:Yes.

Doug:Which is quite ironic because and when we challenge accountants about that, they're horrified, of course, but but it's true. Whereas when you go in with a meeting where you're desperate to listen to the client and you tell me, then that's where the magic happens, isn't it?

Miranda:It is too. And it's interesting because you know, I know we've said not all accountants, but I've run lots of round tables where you know it's um and we'll ask different questions. And what one question we've all have always asked is why do you do what you do? And they all will say we want to see our clients be successful, and yet they don't do the one thing they should do, and that's speak and listen to their client to understand how they can actually build the trust, as you said, and make them successful. So it's there, that's what they want to do.

Doug:Yeah, yeah, absolutely. So, how did you get into Spotlight?

Miranda:Oh, yeah, interesting. Um, so I was at Carbon before, and um, sadly, I got caught up in the redundancies that they did a couple of years ago. And Richard Francis, who I have known since he launched Spotlight back in the day over in Australia, and he heard from my my old boss, who's actually a um carbon, who's a very good friend of mine as well. Uh he said that um I was on the market and he reached out to me and asked if I was interested to come and build the team here in the UK, and um and then I was like, oh well come then, why not? So I've known him for a long time, um, and I liked what the the future was holding for Spotlight and what they were trying to achieve, and then moving into the US markets and North America and was something that um you know I had some appetite over, and I think the US is you know such a different culture, and it's it's I want to be able to put in my bow that I've successfully grown a team in the US, um, and yeah, and we've got a good presence over there, and it's it's actually going really well. So that's how I came around to being in Spotlight. Always wanted to stay in the ecosystem of accounting, uh, because I really enjoy it, and you know, I've got such a big network uh across APAC and over here in the UK, um, and I just really wanted to make sure I still took advantage of that and continued building it.

Doug:Yeah, yeah, good. So, how much time are you spending in the US at the moment?

Miranda:Yeah, um, so uh I I was over early in the year, um, I was in Vegas for all my thoughts, and then I'm back over again in a few weeks. So I'm trying to keep my carbon footprint down to my best ability, but the idea is to you know not do quick in and out trips but be there for a few weeks and you know, do some road trips and continue um building up there and working with lots of partners to help us obviously win win the market in the US because it's it's big and lots of players.

Doug:Yeah. How do you find America compared to the UK in terms of the outlook of accountants?

Miranda:Yeah, um, so they're even they're even further behind in advisory. Like they are literally, and they call it CAS over in the US, they are just stepping like very, very early days. I mean, a lot of them are just also shifting because that big um QBO um on desktop, there's a huge, huge percentage still on desktop, and a lot of firms are are only just moving clients over into the cloud still, you know. It's interesting that they're compared to here. I mean, we thought we were a bit behind than the the Australians, but so CAS is something they are stepping their toes into, but it's a big education of what does that really mean, what skill sets you need, how do you approach it? Where in the UK people will say they already offer advisory, but they're looking to obviously scale that and expand it from what they've got today. Uh, I find them they'll make a decision a lot quicker when it comes to decision on software, they're ready to jump all in and give it a go. If you've obviously, you know, they've listened to what you've got to share and how you can um bring efficiencies and be able to monetize, especially in our space. They're much quicker to jump on board than the UK. But yeah, no, that they're um they've been enjoyable to work with, actually, quite quite good. Some of their events they've they're really, really friendly, um, want to learn, you know, they sort of hang off of everything that you're sharing with them, and I they it just feel it's a lot easier to build a rapport, and you almost you know move into that being a friend and talking about them personally first before they want to talk about what's going on business-wise, you know. So that's quite refreshing and really enjoyable to be part of.

Doug:Yeah, and what excites you most about the spotlight product?

Miranda:Oh, well, the first one is is what we actually do in you know, if someone actually gets and understands our platform, the beauty and ease of building our reports, but also our roadmap, you know, so we've got some exciting integrations coming up. I don't know, just and we've got one in particular which is gonna be a game changer and working with another vendor, and then yeah, our roadmap. So I'm gonna bring it in, but at AI, we've just launched the first MVP of that, but then what we're going to do, um, you know, bringing that into our three-way forecasting as well. I'm super super excited, especially on forecasting, because we all know that if you've done forecasting in spreadsheets, it's it's a headache, uh, lots of open to errors. So being able to streamline what we do even further so that we can start, you know, producing lots of different scenarios a lot quicker. I am that really does excite me. And then we've got a few other things on the roadmap this year that I'm not allowed to quite talk about yet. Yeah, it's a bit things, um, and then we're just doing some partnering. So, one of the things I've talked about is that gap of being able to use a platform such as and tools such as Spotlight, but how do you then take that and obviously one monetize it, but two, bring your clients on the journey with you? And so we're looking at partnering with um another company called Clarity, which I'm happy to speak to. Um, I don't know if you know Clarity at all. Yeah, so we're looking to work with them because that's that sort of you know, that missing part of how they help take the fear away, let them find time, understand the value that they can bring to their clients. So we're gonna be sending some time working with them, and I think that's gonna really be a game changer for us of taking our platform, but then you know, amplifying or um expediting that journey much quicker into bringing on the volume of clients rather than you know the drip feeding that happens at the moment. And that's that's exciting.

Doug:Yeah, absolutely. And I'm sure, like any other business, you've got the 80-20 rule will will probably apply in your business. And what I mean by that, Miranda, is you'll probably have some accountants um who are just flying by this and use it all the time with clients and have some brilliant success stories. Then you may have others who are still dipping their toe in the water with it. But any examples of accountants who have really flown with it and done a great job, but you you don't need to name them if you don't want to, but just in terms of you know, uh reward for seeing people actually use your product and the impact that it must have on clients.

Miranda:Yeah, no, definitely. We have we've seen some really good uptake on some of our clients, and that's because then they've they've come to the table and they've realized do you know what for us to achieve what we want, we have to put this effort in up front once we've signed up to our platform. You know, you like any app, you've got to put the time in up front because otherwise you're not gonna get the ROI. Um, so putting the time in up front, getting it set up, understanding they put together, you know, their matrix of which clients they already know who they're gonna speak to. They might have even done a little bit of a you know, well, we're thinking of doing this and got some input from them. Um, they've not just looked at reporting, they've also thought about forecasting. Every business deserves a forecast, and so many businesses don't do a forecast. So being able to open it up beyond reporting, and then the training. So, not only do they come to all the training that we offer, so one of our differentiations for us is that we do in-person training, we'll go and do workshops with our clients, so it's those clients that embrace that and take that on that we've seen the best results, and then we've got them come back and going, Oh my gosh, you know, we pulled together a forecast which would have taken us maybe two weeks to do. We did it in a few hours. Our clients gone to the bank and they've gone and been able to get you know two million investment, so all alone, yeah. Those kind of um results, that's when you go, Do you know what? Job done, amazing. Like, how can we bottle that and repeat it? And I think if people can hear more stories that it can't use achievable and how they did that, then I think that you again would see a much better uptake and a fear moved away if they just allowed themselves to take the risk and do it.

Doug:Yeah, yeah. I know, I mean, we've talked about client selection, and there there's undoubtedly clients who don't want or need that type of service, but if you were to put a figure on it, a percentage of the SME client-based Miranda, you know, give me give me a rough guesstimate as to how big the market is versus the the relatively small inroads that have been made in terms of offering that sort of thing.

Miranda:Yeah. Um so sorry, are you talking about people that are taking it up? What percentage we're seeing at the moment?

Doug:Give me a flavour for what do you what do you think is this the opportunity in the market? Because the councils will say of 100% of their clients, oh only only 5% need this.

Speaker 02:Yes.

Doug:Whereas actually I'd be closer to 50% might need it, and because they don't know until you've offered it. But I'm just interested in your thoughts on what is the opportunity.

Miranda:I I would say the same. I think it's a 50-50. You'll you'll get, I think there's like a 30%, which are the more complex businesses, you know, consolidations, etc., that are probably the easier ones to get on board, but then there's that other 20%. Like sometimes I hear people saying, Oh yeah, they're they're only a small family business, like they don't they don't want it. It's like, well, hang on a minute, if they're a small family business, are they wanting to leave that legacy somewhere? What what are they, you know, they must be wanting to do something at some point with that business. If you're not having that conversation, who is? I I I I would argue that I don't agree with the fact that they won't want some assistance and some support in understanding you know, at some point they're gonna want to exit maybe and hand over the business or or reduce themselves down to three days a week and two days on a golf course. I don't know whatever they want to do. So I that's my argument, it's that 20%, but I think they're not asking the right questions or understanding their customer, and I think that the you know 20% uplift is a is a game changer. I mean, you know, some of those firms would be able to retire themselves or be acquired if that's their end result.

Doug:I once I remember being at a presentation once by a business growth consultant, and he was he was really excellent, but he he said that every business problem distills down into the business owner either wanting more time, more money, less stress, or a combination of all three. And it was so true. I've never met a business owner yet who doesn't hanker for one or more of those things at the same time. There's very, very few that you know that have everything just down to a T and are completely relaxed about where their business is, and therefore numbers just automatically support that. They just automatically do. Yeah, yeah, interesting. As we draw to a close, Miranda, I'm I'm now thinking about the future of the profession. I started thinking about it as soon as you started talking, actually, in in terms of the model and the impact of AI. In your view, what's gonna happen in the profession in the next let's say five years or so? How do you see things changing?

Miranda:Oh gosh, I don't know. It's such a big question, isn't it? I don't I know. I it's a bit it's gonna be like when we first said everyone's everything's going in the cloud and everyone's going, eh, it's never gonna happen. You're not gonna be able to do that on a a piece of software if people are not going to want it, um, and everyone was in fear they was gonna lose their jobs then, right? Because technology was gonna take it over. And again, I think the same's gonna happen. Like everyone's in this fear of losing their jobs, or um, you know, oh my god, you're gonna use AI and it's gonna be all hallucinated hallucinations, and you know, how can you trust it? But we're not, we're going to find that comfortable ground of how AI, in whichever form it presents itself, actually is very supporting to allow us to just grow in different areas, and I think that in this day and age it's gonna be good for us because it's gonna push us out there and make us talk to people again because that's where we're what we're gonna have to do, because everything else, AI is gonna be able to do it for us. So, yeah, I I I you know for me, I'm not an AI expert, I've I'm learning myself, so it's difficult for me to really I think be able to project and think what I see it being in, but I just think it's gonna make us step up and step outside again, whereas we've all been sat behind computers for far too long.

Doug:Yeah, how many firms have you met where you've seen um younger people too getting involved in advisory discussions? We we've met one or two, Paul and I, um, where it's not an age thing and it's not necessarily an experience thing either, it's a curiosity and it's an ability to ask questions and be curious with a client that often leads to the answers. But you know, have have you met many firms like that?

Miranda:Yes, um, I'm honestly gonna say not as many as I should have done. It's gonna be my customers out there going, what is she saying? But yeah, not not not enough. There's not enough curiosity anymore. Um, you know, I've I always got brought up to say if someone says something, you ask a question because if you ask a question back on that, you're gonna find out a bit more, and then you ask another question, and you just keep digging and digging. Um, and in the end you go, Oh my god, now I understand, now I know what you want. Uh or you know, now I understand and I've learned something, and I don't think we do enough of that, and there needs to be more again.

Doug:Yeah, yeah, I totally agree, Fab. Okay, uh Miranda, that feels like a good place to stop. Um actually. Uh, thank you so much for attending today, and we've I've really enjoyed listening to your insights. I'm sure the listeners will too. Um thank you again. Thank you.

Speaker 05:You've just heard Miranda Kendall from Spotlight Reporting talking about the shift away from compliance due to AI and towards the personal touch and advisory work. This is one of the many topics covered in the Accountants Growth Academy. If you'd like to find out more, you can go to remarkablepractice.com or follow the link in the show notes.

Paul:You'll find more valuable discussions with the leaders of ambitious accounting firms at humanize the numbers.online. You can also sign up to be notified each time a new podcast is made available.

Doug:This is a short snippet from a podcast with Graeme Tenick of Tenic Accountants in which he talks about, amongst other things, the future of the accounting profession. And it's a fascinating listen. If you'd like to hear more, go to your usual podcast platform or listen to it on humanize the numbers.online.

Speaker 03:We should go back to the foundations upon which successful businesses have been built on for generations beforehand. But we should use COVID and technology and the change over the that period since then to elevate that. And I'll give you an example in terms of how people work. That flexibility groundwork is amazing, and that trust should stay, but it should stay within an infrastructure which suits the business and the people that are part of the business in terms. And it's got to be a shared exercise with regards to it. Now, in order to do that, you need to behave differently with your team because if your team aren't all in the office, you cannot have that clarity that you maybe once did have as easily as you once did have, because they're not obviously you in a room and say, look, guys, this is the main thing we want to achieve X. So you're gonna have to deliver it in a different way. You're also gonna have to manage and support your team in different ways, but also ask them for their advice and their engagement in different ways. If you do that, the flexibility I spoke of there before can achieve such huge things.

CHAPTER MARKERS

START TIME | CHAPTER TITLE |

|---|---|

1:09 | Introduction |

3:16 | What does Humanise The Numbers mean to you? |

5:13 | Life in the corporate world |

8:10 | Presence, authenticity and soft skills |

9:46 | Miranda, the human... |

11:48 | How did the start-up world differ? |

17:54 | Doing what you love |

23:09 | Why do accountants resist advisory? |

28:23 | The value of getting to know your client |

30:19 | Where the magic happens... |

31:14 | The road to Spotlight |

33:22 | UK versus US accountants |

35:21 | What excites Miranda about the Spotlight product |

37:28 | Reward and Impact |

43:15 | |

45:07 | Just ask questions |

Click the play button below and use the slider on the audio below to get quickly to the chapters in the podcast.

Resources relating to this podcast:

Miranda and Doug talk about the corporate world and its regimented nature, but also how, when Miranda started working in the start-up world, she felt like she could really make a difference to her team. She feels that her greatest achievement when it came to leading her team was pushing them out of their comfort zone, and then watching what they achieved and how much they loved it.

It you want to know more about working at the edge of your current skill level and the difference that this type of learning can make, please read the Business Breakthrough report 'Repeatedly Reach for Success' by clicking the link in the button below.

Click the button below to discover more about the Accountants Growth Academy.

Remarkable Practice Manager Programme

Could your managers be more skilful, more motivated, or more engaged? Could they be delivering better results for your firm?

In your accountancy firm, it’s not just your financial and technical skills and knowledge that drive performance, it’s the quality of your managers.

When your managers grow in capability and confidence, everything else in your firm improves:

- Team engagement goes up

- Client loyalty strengthens

- Work quality and turnaround time improve

- Profitability increases

The return on investment is clear. When your managers develop, your people deliver.

That is exactly why we created our Manager Development Programme – built specifically for the challenges and expectations of modern accountancy firms.

If you want a stronger firm, start with stronger managers.

Click the button below to read more about our Remarkable Manager Programme and, if you want to discuss it further, please get in touch via the 'chat with us now' button on the website. You'll speak to a real person, not a bot!

Remarkable Practice Client Manager Programme

You secure your firm’s future growth and profitability when your clients are loyal, recommend you more, buy additional services and are open to regular price increases.

And what drives all of that?

Not just technical quality. Not just deadlines met.

It’s the behaviour and mindset of your client managers.

When your client managers improve how they engage and care for clients, your firm’s results improve.

So the question is: Could you be doing more to build your client managers’ skills and mindset?

That’s exactly what our Client Manager Programme is designed to do.

It helps client managers:

- Build deeper client relationships

- Deliver value beyond the numbers

- Handle pricing conversations with confidence

- Spot and act on opportunities for additional services

Great client care is no longer a soft skill. It is a strategic advantage.

Click the button below to read more about our Remarkable Client Manager Programme and, if you want to discuss it further, please get in touch via the 'chat with us now' button on the website. You'll speak to a real person, not a bot!

Doug mentions the Trust Equation when it comes to having the right kinds of conversations with your clients, and why making the conversation all about them and not all about you is vital.

Here is an image of the Trust Equation and below it is the book that Charles H. Green wrote: Trust-Based Selling: Using Customer Focus and Collaboration to Build Long-Term Relationships.

If you want to access the book, please click the link in the button below.

Your Firm’s Future – by Douglas Aitken and Paul Shrimpling of Remarkable Practice

In a world of constant change, uncertainty, and increasing client expectations, one thing separates ambitious firms from the rest: strategic health.

In our book, Your Firm’s Future, we share a practical framework built around 8 essential questions that will help you assess and build your firm's strategic health.

Why does strategic health matter so much? Because when your firm is strategically healthy, it benefits your team, your clients, in fact, everyone connected with your firm.

Strategic health isn’t just an internal metric. It delivers a better outcome for everyone connected to your firm.

Click the button below to take the strategic health of your firm seriously by completing our Strategic Health Diagnostic

or

click the button below that to buy the book.